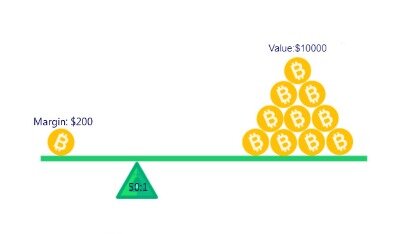

entry and exit points, it is always best to remain cautious with crypto margin trading. A platform will liquidate a trade to ensure that it does not lose any money beyond your initial margin. It is called a margin call, and it happens when the value of the cryptocurrency falls below a certain amount. Most platforms will notify you, but it is also essential that you monitor the margin levels. Your profits will depend on your initial deposit and your leverage. The initial deposit and leverage will vary between different crypto exchange platforms. Some platforms offer a 10 X leverage while others can offer up to 200 X.

Any CFD position on NEO will not earn the right to any GAS token or equivalent that may have been accumulated during the lifetime of the position. From a security point of view, Bithoven is a safe and secure platform, using TLS/SSL encryption, two-step verification, and automatic logouts.

Bitfinex Increases Maximum Leverage For Btc

If you have just begun margin trading in cryptocurrency, begin with small leverages. A 2X or 3X leverage is good enough to start with, as it reduces the risk of liquidation. Always ensure that your initial deposit is what you can afford to lose. When you open a position in crypto margin trading, you can either go short or long.

Before you can borrow from a DeFi, you must put some assets into a collateral account, any crypto asset, cryptocurrency, or token. Indeed, on most DeFi platforms, you can’t borrow more than 75% of your collateral. Through a DeFi, one can borrow as part of a strategy to profit from the market price movements.

Bitcoin margin trading is the best way to leverage position, thus increasing profits. Stormgain supports the leverage with 200 times multiplier, in long and short positions. This means you can speculate on price movements of the cryptocurrency against the ordinary currency . If the price moves in your direction, you make a profit, and if it moves against you, you make a loss. Stormgain offers you a quick and easy way to margin trade Bitcoin and provides one of the biggest leverages among crypto exchanges.

Mt5 Webtrader

Should the property fall in value, perhaps because of an economic recession, the outstanding debt loaned by the mortgage provider will exceed the value of the property. Leverage is therefore a dual feature that can lead to massive profits or losses in crypto or stock margin trading.

We base the price of our cryptocurrency products on the underlying market, made available to us by the exchanges and market-makers with which we trade. Under FCA rules, only professional traders can trade cryptocurrency with derivatives like spread bets and CFDs.

warning from the broker may or may not precede such a liquidation. Margin is the purchasing of digital currencies or traditional securities using a broker’s funds. All a homebuyer needs to do is to put down a percentage of the equity and receive on loan funds from the mortgage provider to settle the rest of the property’s costs. It can be a pump-and-dump scheme where the market participant is manipulating the rate as they have limited assets to liquidate. The value will fall as quickly as it has risen, and you will suffer significant losses. That way, you will only lose a part of your initial deposit if the trade does not go the way you had planned. eToro AUS Capital Pty Ltd. is authorised by the Australian Securities and Investments Commission to provide financial services under Australian Financial Services License .

You also have to hold a certain amount in your account to maintain your position. When you are trading on a lending platform, your initial margin deposit will be held by the platform as collateral. Your leverage amount for margin trading will also depend on the rules of the platform you are trading with and your initial deposit. Margin trading in cryptocurrency also gets referred to as several other terms.

Modern trading tools that you can use to analyse the Bitcoin market are offered by the platform. Using trading tools will let you make more informed investment decisions. To sum up, BitMex is a highly potent trading platform or one of the best cryptocurrency exchanges in the world that allows investors to access global financial markets with the help of Bitcoin. With daily trading volumes of more than 35,000 BTC as well as more than 540,000 accesses on a monthly basis, BitMex is undoubtedly a giant trading platform. The platform allows a BitMEX user to perform highly complex trades using leverage. Their wide range of contracts including Future, Derivatives as well as Perpetual contracts is ideal for earning high profits.

Trading Station Mobile

Often our biggest problems revolve around money, earning it and transporting it. We are dedicated to unlocking the power of people by building a global peer to peer payment logistics platform of the future.

For Bitcoin, the minimum trade size is equivalent to 1% of the price of Bitcoin. If Bitcoin is trading at $40,000 one contract of BTCUSD at FXCM would be worth just $400. Any positions held past 5pm EST may be subject to a “financing charge” which reflects in an FXCM account as “rollover.” Visit our CFD Product guide for more information.

Since all available balances in the account are used as collateral assets, the positions are not that easy to be liquidated under a low leverage or flat market. However, in a volatile market, there is a high probability that all assets in the account will be lost. Therefore, this margin method is useful for institutions and experienced users who are hedging existing positions and proceeding quantitative trading. If cross margin is enabled, the trader risks losing their entire margin balance along with any open positions in the event of a liquidation. Any realized PnL from another position can aid a losing position that is close to being liquidated.

When you choose to go short, you bet against the price of the cryptocurrency. The long position is the opposite of it, which means you are betting that the cryptocurrency price will increase.

Margin trading in crypto markets is a concept borrowed from the stock markets. However, in crypto markets, traders borrow to buy crypto assets, instead of stock, and they borrow from exchanges instead of stockbrokers. Over time, however, blockchain developers have wondered if there is a way to implement margin trading based on the core blockchain principles of decentralization and peer-to-peer architecture. Margin trading enables traders to borrow funds to increase leverage, offering the potential for greater profits than in traditional trading. Still, the potential for greater rewards also comes with higher levels of risk, particularly given the volatility of digital assets. If you wish to learn more about margin trading, please visit its knowledge base article. Eligible Bitfinex users can obtain financing for margin trading through the peer-to-peer financing marketplace available through Bitfinex.

- Some people call it shorting bitcoin, while others may refer to it as trading in cryptocurrency with leverage.

- This limit is currently £100,000 notional per client across all cryptocurrency holdings.

- Forex is a reasonably liquid market and accessible to traders with relatively modest amounts of capital.

- If you are long, for Bitcoin you will pay a daily overnight funding charge of 0.0694% (25% per Annum) for positions held at 10pm UK time.

- One you have found the Cryptocurrency you want to trade just double click to subscribe and the instrument will appear in the Dealing Rates window.

If the price goes down instead, the smart contract will take over and liquidate your collateral to repay the loan to the liquidity pool. With this facility, however, you can increase your profit potential, especially in a bullish market. If you own $100 worth of ETH, for example, and you anticipate the price to rise, you can put it into a DeFi as collateral and take a loan of $75. Take engaging step-by-step courses, attend expert-led seminars and webinars. There is currently one accepted decentralised ledger which records all cryptocurrencies transactions – as well as an equivalent for ether – called the blockchain. When the software of different miners becomes misaligned, a split – or ‘fork’ – in the blockchain may occur.

With your initial deposit and the loan, you can then buy an asset whose price you believe will rise. 101 Ways to Pick Stock Market Winners You need the number one bestselling investment guide, the definitive text for day traders, investors and stock pickers. We reserve the right to determine which blockchain and cryptocurrency unit have the majority consensus behind them.

Given the company is relatively new to the industry, we cannot yet comment on its track record. In terms of fees, depositing is free, however, there is a withdrawal fee on top of the 0.2% trading fee. For Bitcoin, the withdrawal fee is 0.0015 BTC and for Ethereum, 0.0428 ETH. XTB Limited is authorised and regulated by the UK Financial Conduct Authority with its registered and trading office at Level 9, One Canada Square, Canary Wharf, E14 5AA, London, United Kingdom . Use the link below to create your account through our application. Open an account or log in to receive full access to the news section. For more on leverage check out our articleWhat is Leverage in Forex and How to Use It.

A DeFi is an app that uses a blockchain as its backend, and its processes are guided and implemented by smart contracts. A stablecoin is a coin whose value is pegged to real-world asset or currency such as the US dollar. If you trade or invest ADVFN has the tools you need to make the right decisions. The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. See below overnight funding calculations for bitcoin as an example.

Professional clients are exempt from regulatory limits on leverage in place for retail clients, and are able to trade on lower margins as a result. You can find out more, and check your eligibility, on our professional trading page. In general, forex is a reasonably liquid financial market but even forex is susceptible to periods of low liquidity. Bank holidays and weekends can even cause a dip in liquidity – and during these periods, the cost of trading will increase. Equity is another word for the value of your account in real time. If you have open trades, ‘equity’ is the account balance plus the floating profit of all your open positions.

Thus, BitMex is a P2P trading platform, which provides leveraged contracts that are sold and bought in Bitcoins and not fiat currency. It must be noted that Bitmex handles only Bitcoin and offers margin trading even when a trader purchases and sells altcoin contracts. Bitcoin is probably the most famous cryptocurrency, especially after its phenomenal growth in 2017.

How Does Leverage Trading Work?

Launched in 2009, Bitcoin was the first decentralised cryptocurrency that opened the way for many other cryptocurrencies using the same Blockchain technology. This success has made Bitcoin a popular investment tool for many traders as they begin to trade and seek to diversify their activities with a new and exciting financial instrument. By this article we gathered shortened info on all about Bitcoin trading.

The broker can no longer support the open positions due to the decrease in margin levels. But, if a trader wished to go long on USD/EUR and open one mini lot and the trading account is a GBP account, the first step is to calculate the USD/GBP price. If the margin requirement is 3%, the required margin will be £330. When the trade is completed, the margin returns to the trader’s account as ‘freed’, ‘released’ or ‘usable’, and can be used to enter into new positions. To commence margin trading, the investor opens an account with a broker using the required percentage of the full value of the proposed trade .

People who wish to invest in Bitcoin normally need to first setup a digital wallet, i.e. a smartphone or computer-based electronic device that allows users to buy the digital Bitcoins online. Bitcoin is a popular digital currency which was invented in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. It is the original and most widely used cryptocurrency in circulation. Apart from this, all the withdrawals on the exchange are audited personally by 2 employees of BitMex before they are finally sent.

Simply log in to your Bithoven account, switch to the Margin trading page, and select Web Terminal. Our tools and calculators are developed and built to help the trading community to better understand the particulars that can affect their account balance and to help them on their overall trading. Leverage trading Bitcoin or crypto essentially lets you amplify your potential profits by giving you control of between 5 and even up to 100 times the amount you needed to open. You can use the ‘Close at Loss’ order to minimise and prevent further losses – by automatically closing your trade at a predefined rate. You can use the ‘Close at Profit’ order to ‘lock in’ your potential profits – by automatically closing your trade at a predefined rate.

Some people call it shorting bitcoin, while others may refer to it as trading in cryptocurrency with leverage. Even though all of these refer to the practice of margin trading in cryptocurrency, it is easy to get confused when people use the terms interchangeably.

While most of these exchanges started as a place where you could buy and sell crypto assets, they soon saw an opportunity to lend funds to those who needed it to trade. When developing a trading strategy, it is important to remember that the cost of bitcoin is determined solely by supply and demand. Due to the decentralised and completely unregulated nature of the Bitcoin, it can be very volatile. Notwithstanding the above, it is still possible to analyse price dynamics and make informed investment decisions. You simply need to adapt your trading strategy to the volatility of the bitcoin and be prepared for significant fluctuations in its value during the investment and market analysis. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.